Guide to the Federal Solar Tax Credit 2021 in USA

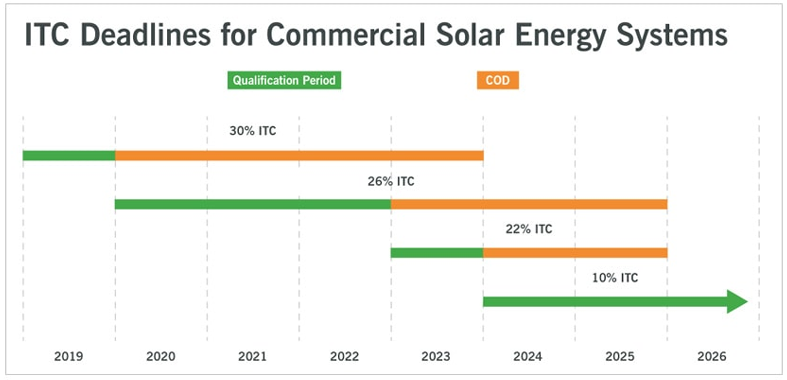

Guide to the Federal Solar Tax CrSeveral subsidies and rebates are being provided by the United States government for the installation of solar panels including the federal solar tax credit 2021. Both residential homeowners and commercial property owners can avail the renewable energy tax credit, significantly reducing the payback time for solar system investment. The energy policy act of 2005 took the initiative of solar investment tax credit not just for reducing the initial investment to a significantly lower amount but also to encourage people to undertake more and more solar installation systems. Initially the Solar Federal Tax Credit was decided to end in 2007, however, with the popularity and mass increment in solar panel installation, this program has been extended for homeowners till 2026. The terms of the credit however, differ from year to year.

Solar investment tax credit: What is it?

- About 26% of the expense of the solar PV system, can be claimed on the federal income taxes. This claimed Solar Panel Tax Credit on the income taxes is referred to as the federal solar investment tax credit.

- Electricity for a home located in US can be generated by placing the system in service during the tax year

- Before 31 December 2021, the Solar PV system must be installed into service for claiming the credit in by December 31 2022

- No upper limit is there for the amount claimed.

Solar Federal Investment Tax Credit (ITC) Cheat Sheet US

Are you eligible for claiming the solar investment tax credit in 2022?

Only after satisfying the following criteria you will be eligible for solar investment tax credit:

- Between January 1 2006 and December 31 2021 the Solar panel system was not placed in service

- The solar system is installed on a residential or commercial location in the US. However, it is not necessary to be placed on your primary residence.

- The solar panel tax credit can be claimed only on the “Original Install”. For instance, in case if the Solar PV system is being used for the first time or is new.

Difference between Tax Credit and Tax Rebate

The most important thing to understand here is income tax credit is not same as tax rebate.

A dollar-for-dollar decrease in the amount of income tax that you might have owed is known as a tax credit. For example, a $1000 claim of federal tax credit subsequently decreases your federal income taxes due by a $1000. The total balance of tax due to the IRS is counter-balanced by tax credits

The most important thing to understand here is income tax credit is not same as tax rebate.

A dollar-for-dollar decrease in the amount of income tax that you might have owed is known as a tax credit. For example, a $1000 claim of federal tax credit subsequently decreases your federal income taxes due by a $1000. The total balance of tax due to the IRS is counter-balanced by tax credits

What expenses are included?

Given below are the following expenses that are included in the tax credit:

- Solar PV cells or PV panels used for powering and Solar attic fan (note that not fan itself)

- The labor cost for original installation, assembly, or an onsite preparation inclusive of the developer peace inspection costs and permitting fees

- Inverters, wirings, mounting equipments and other balance of system equipment.

- The associated residential solar panel installation and commercial solar panel installation which exclusively charges the energy storage devices in a corresponding tax year to when the system is finally installed

- The associated residential solar panel installation and commercial solar panel installation which exclusively charges the energy storage devices in a corresponding tax year to when the system is finally installed